OUR APPROACH

CUSTOMIZED INVESTMENT STRATEGIES TO CLIENT’S SPECIFIC NEEDS

built on four key pillars under which we operate.

Transparency

We believe that trust and transparency are paramount and cultivate relationships with investors and partners based on mutual trust and complete openness.

Safety

We commit to the highest standards of risk-management in all investments. We use modern tools to ensure we are operating in a safe and sustainable manner.

Excellence

We pride ourselves on the level of excellence provided in our financial performance, customer service, and organizational efficiency.

Innovation

We believe in providing our clients with products that deliver superior performance and access to forward-looking investments, in line with their long-term objectives.

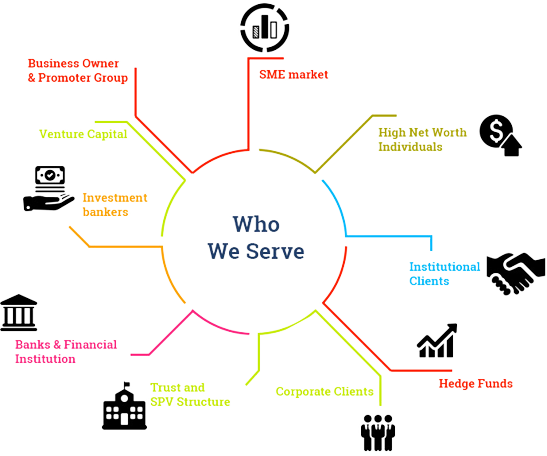

Our clients are our number one priority

At Victory Bull, we understand and evaluate our clients’ specific needs and create customized solutions to fulfil them. We have found that developing personal and long-term relationships with our clients and maintaining a transparent exchange of information is key to understanding their needs and providing them with unparalleled services. At Victory Bull, We serve.

EFFECTIVE DIVERSIFICATION – BEYOND ASSET ALLOCATION

(DIVERSIFIED STRATEGY)

Key Takeaways

- You receive the highest return for the lowest risk with a diversified portfolio.

- For the most diversification, include a mixture of stocks, fixed income, and commodities.

- Diversification works because the assets don’t correlate with each other.

- A diversified portfolio is your best defense against a financial crisis.

How Diversification Works

Stocks do well when the economy grows. Investors want the highest returns, so they bid up the price of stocks. They are willing to accept a greater risk of a downturn because they are optimistic about the future.2

Bonds and other fixed income securities do well when the economy slows. Investors are more interested in protecting their holdings in a downturn. They are willing to accept lower returns for that reduction of risk.3

Join Our Team

Languages

LAST YEAR VICTORY BULL CLIENTS

ACHIEVED 21% ROI/PA

SEE THIS YEARS PERFORMANCE

RISK DISCLAIMER:

Please be advised that trading in any market carries risk, and trading foreign exchange (“FX”), futures, options, contract for differences (CFDs) and precious metals involve a substantial risk of loss. Leverage or “gearing” creates enhanced risk and loss exposure. Even though risk can be managed, it cannot be eliminated and losses can quickly compound and exceed your initial deposit. You are liable for all losses and debits in your account.

Investment involves risk. As a general rule, you should only trade in financial products that you are familiar with and understand the risk associated with them. The risk warning described in each financial product below is not exhaustive, you should carefully consider your investment experience, financial situation, investment objective, risk tolerance level and consult your independent financial adviser as to the suitability of your situation prior making any investment. You must satisfy yourself that dealing in our products is permitted under the laws of the country that you reside.

RISK DISCLAIMER:

Please be advised that trading in any market carries risk, and trading foreign exchange (“FX”), futures, options, contract for differences (CFDs) and precious metals involve a substantial risk of loss. Leverage or “gearing” creates enhanced risk and loss exposure. Even though risk can be managed, it cannot be eliminated and losses can quickly compound and exceed your initial deposit. You are liable for all losses and debits in your account.

Investment involves risk. As a general rule, you should only trade in financial products that you are familiar with and understand the risk associated with them. The risk warning described in each financial product below is not exhaustive, you should carefully consider your investment experience, financial situation, investment objective, risk tolerance level and consult your independent financial adviser as to the suitability of your situation prior making any investment. You must satisfy yourself that dealing in our products is permitted under the laws of the country that you reside.

victorybull.com operates under a license or registration in various jurisdictions. For details please visit our Regulatory Page