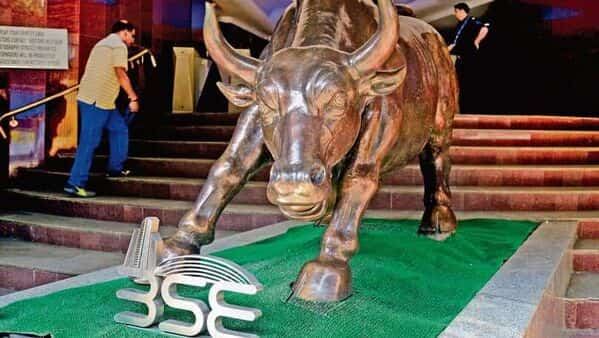

On Tuesday, equity indices failed to hold onto their morning gains, with the Sensex dropping 236 points due to a sell-off in information technology firms and negative global market trends The opened higher but was unable to maintain its gains, falling 236 points, or 0.43 percent, to 54,052.61. It traded between 53,886.28 and 54,524.37 during the day. The broader NSE Nifty ended at 16,125.15, down 89.55 points, or 0.55 percent Among the Sensex pack’s biggest laggards were Tech Mahindra, Hindustan Unilever, HCL Technologies, Asian Paints, NTPC, Tata Steel, Infosys, Axis Bank.

and Bajaj Finserv. Dr Reddy’s Laboratories, HDFC, Power Grid Corporation of India, Kotak Mahindra Bank, HDFC Bank, and Nestlé, on the other hand, were among the biggest gainers Hong Kong, Shanghai, Seoul, and Tokyo all finished lower in Asia. In the afternoon, European exchanges were also trading down. On Monday, US stock markets finished higher Brent crude, the international oil standard, fell 0.46 percent to $112.9 per barrel According to stock market data, foreign institutional investors continued their selling binge on Monday, offloading shares worth a net Rs 1,951.17 crore.